Blog

Absolute Trust Talk Interview: Beyond Borders: International Estate Planning Essentials for Families (Part 3)

One of the most common mistakes I see in my practice happens when well-meaning US citizens assume their domestic...

Absolute Trust Talk Interview: Beyond Borders: International Estate Planning Essentials for Families (Part 2)

The most expensive mistakes in international estate planning often occur not because families lack good intentions,...

Absolute Trust Talk Interview: Beyond Borders: International Estate Planning Essentials for Families

International estate planning involves a range of considerations that extend far beyond typical domestic planning....

3 Remarkable Pet Trust Cases and the Lessons They Teach Us

Providing for your pet’s future can sometimes bring out a pet owner’s most...

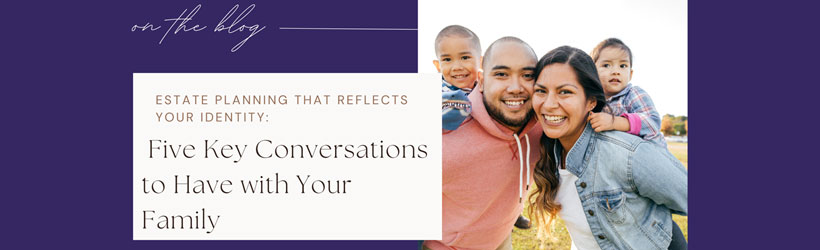

Estate Planning That Reflects Your Identity: Five Key Conversations to Have with Your Family

When creating an estate plan, your primary focus may be on distributing your wealth and property. However, your legacy...

Who Should Have an Estate Plan?

If you are an adult, you need an estate plan. Regardless of age, financial status, or stage in life, having a plan in...

The Rockefeller Dynasty Trust: A Blueprint for Lasting Legacy and Generational Wealth

Introduction When we think of generational wealth and legacy, few names stand out like the Rockefeller family. Their...

Handling a Loved One’s Debts After They Die

Many Americans anticipate carrying debt for life, with nearly half expecting to pass away still owing money. But what...

Estate Planning for Newlyweds: Building Your Future Together

Marriage marks the beginning of a new journey, and as you merge your lives, it’s the perfect time to establish an...

Estate Planning for Newlyweds

As you embark on the exciting journey of married life, now is an ideal time to consider creating an estate plan....

5 Common Mistakes to Avoid When Including Pets in Your Estate Plan

Including your pets in your estate plan is a thoughtful way to ensure their well-being after you pass away. However,...

IRS Announces Increased Gift and Estate Tax Exemption Amounts for 2025

The IRS has revealed that, starting in 2025, inflation adjustments will bring significant increases to the annual gift...

Why Cinderella’s Father Should Have Had an Estate Plan

Many of us are familiar with the story of Cinderella. Central to the story is the relationship between Cinderella and...

If My Will Is Filed with the Court, Will It Go through Probate?

The impact of a loved one passing is intensely personal. That may be one reason so many people are concerned about the...

Inheriting Wealth: What It Means to Be a Beneficiary

What to Know About Receiving an Inheritance The passing of a loved one is a difficult experience. That can make the...

How Can You Move Assets to Future Generations With the Least Tax?

Important note: All exemption amounts mentioned in this article apply to U.S. citizens only and were current as of...

Estate Planning 101: Wills vs. Trusts

The Basics of Estate Planning: Understanding Wills and Trusts Two of the most fundamental estate planning instruments...

4 Types of International Estate Planning

International Considerations in Estate Planning International estate planning issues are not rare these days. They...